March 2016

In Nigeria’s March 2015 presidential election, the incumbent peacefully conceded defeat and transferred power to an opposition party for the first time since the end of military rule in 1999. Nigeria has the largest economy in Africa, generating about 20% of the continent’s total GDP, and transfers a far greater proportion of resources to sub-national government than any other country. Yet standards of governance remain extremely low, public services are among the worst in Africa and economic growth has exacerbated inequality rather than creating jobs. According to the National Bureau of Statistics, two out of three Nigerians live in poverty.

The federal system of governance in Nigeria is failing to provide the basic welfare for all citizens that the 1999 Constitution prescribes. On the first anniversary of the election victory of President Muhammadu Buhari, this Briefing Note examines the origins and purpose of the federation, state governments’ financial management and responsibilities, governors’ arbitrary power, and the need to increase internally generated state revenue. It suggests practicable reforms that could help change state governments from elected autocracies to agents of social and economic development.

A federation for peace

Nigeria’s three-tier system of government – federal, state and local government area (LGA) – was born out of military rule. At independence in 1960, Nigeria had elected governments in its three regions – northern, western and eastern – and at federal level.1 The regions were autonomous and broadly self-sufficient, but prone to intense rivalry between their dominant ethnic groups: the Hausa-Fulani, Yoruba and Ibo, respectively. After two military coups and the eastern region’s failed bid for secession, which triggered the Biafran War (1967–70), Gen. Yakubu Gowon’s regime replaced the regions with 12 states. The purpose of this “military federalism”2 was to prevent Nigeria breaking apart.

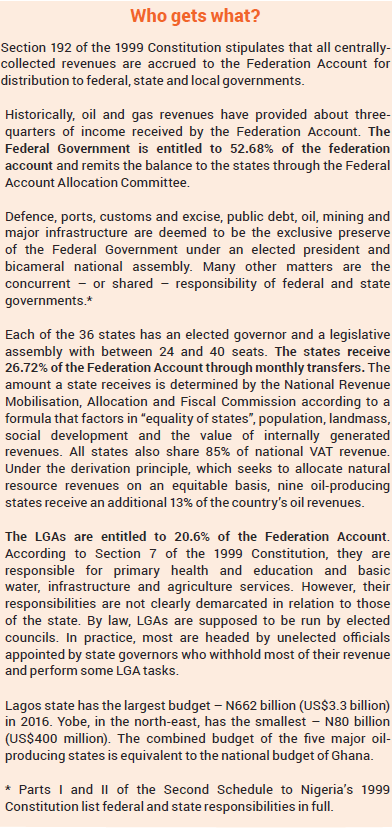

In theory, by concentrating power and wealth centrally, the Federal Government could distribute resources to the states and balance the many ethnic, religious and other interest groups’ competing demands. Successive military rulers periodically created more states. By 1976, there were 19; two more were added in 1987, and a further 15 in 1996, as well as the Federal Capital Territory, which contained the national capital Abuja. The number of states has remained unaltered for two decades, but the creation of LGAs in 1979 established a third tier of government that has progressively expanded.

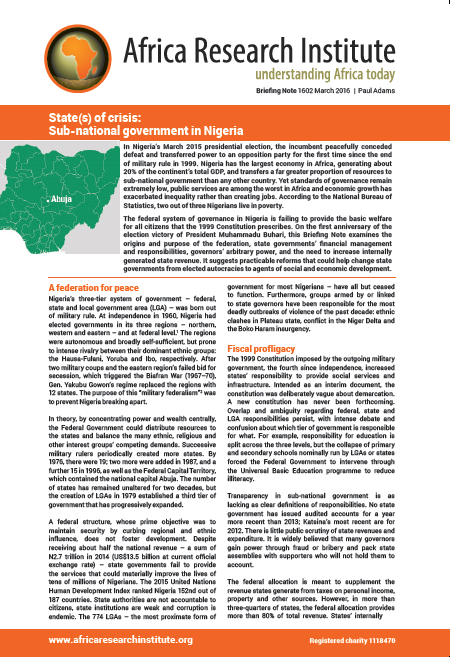

A federal structure, whose prime objective was to maintain security by curbing regional and ethnic influence, does not foster development. Despite receiving about half the national revenue – a sum of N2.7 trillion in 2014 (US$13.5 billion at current official exchange rate) – state governments fail to provide the services that could materially improve the lives of tens of millions of Nigerians. The 2015 United Nations Human Development Index ranked Nigeria 152nd out of 187 countries. State authorities are not accountable to citizens, state institutions are weak and corruption is endemic. The 774 LGAs – the most proximate form of government for most Nigerians – have all but ceased to function. Furthermore, groups armed by or linked to state governors have been responsible for the most deadly outbreaks of violence of the past decade: ethnic clashes in Plateau state, conflict in the Niger Delta and the Boko Haram insurgency.

Fiscal profligacy

The 1999 Constitution imposed by the outgoing military government, the fourth since independence, increased states’ responsibility to provide social services and infrastructure. Intended as an interim document, the constitution was deliberately vague about demarcation. A new constitution has never been forthcoming. Overlap and ambiguity regarding federal, state and LGA responsibilities persist, with intense debate and confusion about which tier of government is responsible for what. For example, responsibility for education is split across the three levels, but the collapse of primary and secondary schools nominally run by LGAs or states forced the Federal Government to intervene through the Universal Basic Education programme to reduce illiteracy.

Transparency in sub-national government is as lacking as clear definitions of responsibilities. No state government has issued audited accounts for a year more recent than 2013; Katsina’s most recent are for 2012. There is little public scrutiny of state revenues and expenditure. It is widely believed that many governors gain power through fraud or bribery and pack state assemblies with supporters who will not hold them to account.

The federal allocation is meant to supplement the revenue states generate from taxes on personal income, property and other sources. However, in more than three-quarters of states, the federal allocation provides more than 80% of total revenue. States’ internally generated revenue (IGR) falls well short of even covering personnel costs. Furthermore, IGR usually relies on sources that require the least tax effort such as PAYE – income tax automatically deducted at source from salaries. According to the National Bureau of Statistics, two-thirds of states make at least half their  IGR from this source.

IGR from this source.

Akwa Ibom, the state that produces the most oil, derives almost all of its N462 billion (US$2.3 billion) budget from the federal “handout”. It covers only a fraction of its recurrent costs with local revenue and routinely accrues substantial bank debts and salary arrears. The example may be extreme, but when receipts from the federal revenue pool in the first nine months of 2015 halved compared to the previous year, due to the collapse in global oil prices, most states rapidly became insolvent. One of Buhari’s first decisions as president was to authorise a bailout fund for 27 indebted states endowed with N338 billion (US$1.7 billion) of federal government funds – a sum substantially larger than the annual budget of the Ministry of Health or the budget for defence and the armed forces. In addition, the Debt Management Office converted N324 billion (US$1.6 billion) of state debt to long term bonds.

“If everyone in the states had budgeted correctly there would have been no need for this [bailout],” a former state finance commissioner told ARI. “Even when the oil price was high, virtually all the states were spending more than they earned”. Whether the bailout was to stave off a potential collapse of banks that had lent large sums to state governments or was politically motivated is unclear. But the finance commissioner regards the decision as a missed opportunity. “[Buhari] could have imposed conditions – revenue and spending targets – on the states before agreeing to bail out their debts and approve new money”. The Federal Government has in effect refunded the costs of state mismanagement and profligacy.

The governor’s domain

A governor’s character and intentions are the most important factors in determining a state government’s performance. This seldom works to the people’s advantage. According to Yusuf Tuggar, a candidate for the governorship of Bauchi in 2011:

“Many elected governors have no programme or blueprint at the start of their tenure and instead of working out a few priorities that the state can afford, they set up expensive projects which they pass on to the [Federal Government] to fund, or abandon them when the funding runs out. In my state, this involved roads and airports that we don’t need and for which some of the expenditure can be diverted into political funding.”

Misconceived or abandoned state-funded projects are found throughout the country, from Cross River’s grand plan to rival Dubai as a tourist attraction to a former governor of Jigawa’s scheme to turn his Sahelian state into an IT hub. The government of Katsina, Buhari’s home state in the far north-west, built a school in a different country – Niger.

State elections seldom hold anyone to account. Poor provision of health care, housing, education and infrastructure or lack of support for agriculture does not prevent the corrupt or ineffective from securing re-election. Electoral fraud is commonplace. “A governor is usually voted in because the political ‘godfather’ decided he should be,” explains Jibrin Ibrahim, professor of political science at Ahmadu Bello University in Zaria. The state administers LGA elections, which are typically either rigged or not held at all. “It’s very rare that a candidate from a party in opposition to the governor wins an LGA seat,” says Prof. Ibrahim.

Winning an election is an expensive business. Financial backers and supporters expect a payback within the maximum of two four-year terms a governor can serve. But the rewards are lucrative. By law, governors in many states receive their salary for life and keep perks from their time in office such as official houses, cars and furniture. Furthermore, many aspire to move further up the political ladder; for example, to a seat in the Federal Senate, where they can count on total remuneration of more than US$1.5 million a year. Short-term personal gain trumps concerted attempts at state management and development.

The marginal significance in most states of IGR further undermines representative government and accountability. State governments do not depend on the citizens they govern for revenue, so the citizens have little or no leverage. “As long as they receive a handout each month from the centre, governors can rig state election[s] and the constituents have no say in who governs them,” says Chidi Odinkalu, a senior lawyer and chair of the National Human Rights Commission. However, the oil price collapse is a warning against undue indifference among state governments. The Federal Government cannot afford repeated bailouts. According to the DFID-funded State Partnership for Accountability, Responsiveness and Capability (SPARC) programme:

The marginal significance in most states of IGR further undermines representative government and accountability. State governments do not depend on the citizens they govern for revenue, so the citizens have little or no leverage. “As long as they receive a handout each month from the centre, governors can rig state election[s] and the constituents have no say in who governs them,” says Chidi Odinkalu, a senior lawyer and chair of the National Human Rights Commission. However, the oil price collapse is a warning against undue indifference among state governments. The Federal Government cannot afford repeated bailouts. According to the DFID-funded State Partnership for Accountability, Responsiveness and Capability (SPARC) programme:

“If oil were at US$20 a barrel, at 2014 budget levels only three states would be able to cover their recurrent costs with recurrent revenues: Lagos, because it generates substantial revenues internally and depends less on federal transfers; Kano, because of the amount the state receives in federal transfers due to the large number of local government areas; and Katsina, because the overhead and personnel costs are very low compared to other states”.

The nature of state governorship varies regionally. In the mainly Muslim north, where “cash and carry politics” is the norm according to one candidate in the recent state elections, imams and other religious leaders exert a powerful influence over state governments. The decision by almost all state governors in the north who took office in 1999 to adopt sharia law in the criminal code subordinated development objectives to religious observance. In the southern states, the political “godfathers” – former governors and their business backers – hold sway. Only in the south-west is there “a stronger culture of protecting the mandate of the electorate, so the popular pressure on the governors to perform is much higher than in most other parts of the country”, says Prof. Ibrahim. “But in general state governors are so powerful that they can choose to do whatever they want, which includes doing nothing.”

Improving governance is far from straightforward. A detailed study by SPARC of 10 states, rating each for governance systems and processes, found that Jigawa, in the far north, and Lagos had the greatest capacity to deliver realistic budgets, decentralise cash control, deliver improved procurement, account for LGA finances, manage staff for performance and

provide the public with better access to information.3 However, when Jigawa was advised to invest in corporate planning to improve its efficiency and quality of staffing, the state refused in favour of continuing to fund five emirate councils run by politically influential imams.

Lagos: a state of exception?

Lagos is frequently cited as setting the standard for improved state governance. It is the smallest by area but wealthiest state, home to Nigeria’s commercial capital, and has an abundance of well-qualified people. A decisive factor, however, in changing state administration was having its federal funding cut off in the early 2000s during a dispute between then President Olusegun Obasanjo and state governor Bola Tinubu, over Tinubu’s decision to create new LGAs in his domain. Shortage of funds forced the governor to assess what could be done to maximise the state’s IGR. But to raise tax revenues from various sources, including property, required a promise of benefits; and to make it sustainable those benefits had to be delivered to taxpayers. Federal funding resumed in 2007, but taxes still produce 60% of Lagos’s revenue. Its IGR, about N300 billion (US$1.5 billion) in 2014, is equivalent to the combined IGR of 32 of Nigeria’s 35 other states.4

Reliance on IGR made the Lagos state government more accountable to its electorate, who in turn became more aware of their right to judge its performance. Under Tinubu’s protégé and successor, Babatunde Fashola, crime was reduced, the environment improved, roads were built and the transport system expanded. Prompt action to contain a possible outbreak of Ebola in 2014 demonstrated governmental competence. Now that Fashola is a federal minister, many expect Nasir el-Rufai in Kaduna state, in the north-west, to earn the reputation as Nigeria’s most praiseworthy state governor. Elected in 2015, el-Rufai moved quickly to close the state’s commercial bank accounts; eliminate “ghost workers” from the payroll by introducing digital ID for the civil service; concentrate resources on infrastructure, transport and public services; and ensure that LGAs receive their correct share of funding.

While the marked improvement in the administration and revenue collection in Lagos state are commendable, admiration needs to be tempered. As a former state commissioner told ARI:

“Lagos could achieve far more. The state piled up huge debts to fund infrastructure on the wealthy islands, but we could have done better if more had been spent on housing and new towns on the mainland and the outer reaches of Lagos, which would have reduced congestion and created jobs. There was no emphasis on taking care of the less well-off. Lagos state since 1999 has done nothing for the under-privileged and low-income earners that make up about 90% of the population”.

The nature of politics and corruption has not altered. The same party – the Action Congress of Nigeria, now part of the All Progressives Congress national coalition – has controlled Lagos since 1999, which ensures that political patronage strongly influences investment decisions. Contract inflation is rife and transparency poor. As one donor official put it, “Lagos looks shiny from a distance, but not when you look closely”.

Detached states

Government in Nigeria “is detached from its people at every level of the federation”, says Chidi Odinkalu. The restoration of elected civilian government in 1999 has done little to invigorate state or local governments. The failure to promote transparent, accountable sub-national government as the engine for local development is a result of weak institutional capacity and lack of political will. Although most states appear to have been set up to fail economically, demands to create more continue. As a Nigerian political commentator put it to ARI, “people on a gravy train don’t ask to stop the train”.

Nigeria’s crude oil earnings declined by 40% in 2015. Low oil prices mean that states cannot rely on the Federal Accounts Allocation Committee to increase their diminished monthly payments. A process of “structural adjustment” is required. African Development Bank country director for Nigeria Ousmane Dore told ARI “we are very worried about state governments’ finances”.5 Some states will try to borrow their way out of difficulty rather than focusing on what, according to Dore, is “the main problem”: the lack of IGR. In the short term, the Federal Government needs to be clear that it will not reward profligacy with further bailouts. This would force state governors to live within their means, controlling expenditure and augmenting income by raising revenues, and providing services in return.

In the longer term, solutions abound that look effective and straightforward on paper. The federal allocation formula could be altered to reward better governance. The number of states could be reduced to create more economically sustainable units. The overlap in responsibilities between tiers of government could be eliminated. However, many such measures would require constitutional amendments that are extremely unlikely or well-nigh impossible to implement within Nigeria’s political economy for other reasons.

Less ambitious reforms may be possible. The prudent guidelines on government spending and debt that the Fiscal Responsibility Act requires are only binding on the Federal Government. The same limits and guidelines should apply to state governments to prevent a recurrence of the recent insolvency and bailout. The Debt Management Office should also have increased powers over state government borrowing. Stricter requirements for disclosure of revenue and spending, and the imposition of conditions, would improve state financial management; as would timely, independent audits of state-owned enterprises and the gradual privatisation of such companies. A new initiative, BudgIT (yourbudgit.com), is already making headway in providing the public with budgetary information that enables citizens to monitor the performance of their elected representatives.

The 1999 Constitution Alteration Bill passed by the National Assembly in 2015 included a provision securing the financial autonomy of state assemblies. This would have strengthened the authority of state legislatures over the executive, but other provisions in the Bill led to it being blocked by the outgoing president, Goodluck Jonathan. Legislation is urgently required to ensure that state assemblies cease to be mere appendages of governors.

The Independent National Electoral Commission (INEC) won praise for its conduct of the 2015 presidential election. Biometric identification was used effectively and the commission succeeded in maintaining its independence and integrity under the most testing circumstances. More credible state government elections would make it harder for state governors and their “godfathers” to secure power by fraudulent means.

The abolition of the state electoral commissions appointed by governors would be a step towards improving the autonomy of LGAs. Prof. Ibrahim, a member of the late president Yar’Adua’s Electoral Reform Commission, told ARI that “in every part of the country the commission visited, everyone wanted the LGAs to be elected fairly and democratically because that is the branch of government closest to everyone’s lives”. The task of organising LGA elections should be assigned to INEC. If elected, as opposed to selected, LGAs could be held to account by local voters, demand their federal allocation from state governments and do what they are mandated to do: deliver basic services at grassroots level.

Nigeria’s states are in crisis. But modest improvements in IGR, financial management, conduct of elections, the autonomy of state assemblies and LGAs, and service delivery are readily achievable and would improve the lives of millions of Nigerians.