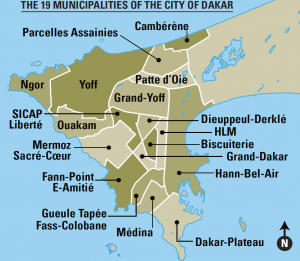

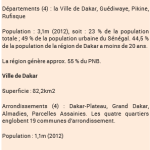

Central and municipal governments are being overwhelmed by the rapid growth of Africa’s cities. Strategic planning has been insufficient and the provision of basic services to residents is worsening. Since the 1990s, widespread devolution has substantially shifted responsibility for coping with urbanisation to local authorities, yet municipal governments across Africa receive a paltry share of national income with which to discharge their responsibilities.1 Responsible and proactive city authorities are examining how to improve revenue generation and diversify their sources of finance. Municipal bonds may be a financing option for some capital cities, depending on the legal and regulatory environment, investor appetite, and the creditworthiness of the borrower and proposed investment projects. This Briefing Note describes an attempt by the city of Dakar, the capital of Senegal, to launch the first municipal bond in the West African Economic and Monetary Union (WAEMU) area, and considers the ramifications of the central government blocking the initiative.

Contested capital

During the 2000s President Abdoulaye Wade sought to establish Dakar as a major investment destination and transform it into a “world-class” city. A massive construction programme created new roads, shopping malls and hotels, as well as controversial creations such as the Monument de la Renaissance Africaine and Porte du Troisième Millénaire. In 2008, Dakar played host to the Organisation of the Islamic Conference (OIC) summit. Work commenced on a new international airport. Wade’s grand vision echoed that of President Léopold Sédar Senghor in the 1960s.

For most Dakarois, the benefits of new infrastructure were elusive. “You can’t eat roads” was a common saying in a city where only one in five could find full-time employment. The chronic shortage of jobs and affordable housing, food price riots, poor transport services and traffic congestion, flooding, erratic waste management, broken sewage pipes and frequent power cuts typified the “other” Dakar. In the slums and squatter communities where 40% of the population live, and in many formal housing and business areas, the state is largely ineffectual. Amadou Diop, a professor of geography, has described “the key characteristics” of his city as “uncontrolled growth, unorganised and unbalanced land occupation, a marked crisis and a declining environment”.2

Khalifa Sall of the Parti Socialiste was elected Mayor of Dakar in 2009, unseating an ally of Wade. He promised to improve the city, especially for its poorer residents, and to ensure much greater public participation in its affairs. Sall was re-elected in 2014 and by then had emerged as a standard bearer for active local government throughout Africa as general secretary of the International Association of Francophone Mayors (AIMF) and president of the United Cities and Local Governments of Africa (UCLGA). In 2012, Dakar hosted Africities, UCLGA’s triennial gathering of thousands of local government experts and officials from across the continent. Khalifa Sall also pressed for the adoption of an African Charter on Local Government and the establishment of an African Union High Council on Local Authorities. For Sall, those closest to the people – local government – must drive pro-poor development or it will not occur at all.

Dakar has long been the key battleground for competing political and business interests. Early in Khalifa Sall’s first term, for example, conflict erupted between his administration and Wade over waste management in the capital. When flooding occurs, responsibility for making good the damage is always disputed. Although the parties of Dakar’s mayor and the current president, Macky Sall, joined forces to unseat Wade, and the two frequently voice their willingness to work together for the betterment of Dakar, they are political rivals. When party politics are to the fore, as they were during the 2014 local elections, this becomes particularly relevant. Equally significant to the pace and efficacy of the development of Senegal’s capital is the country’s ongoing decentralisation programme.

A confusion of powers

Senegal’s 1996 Municipal Administration Code was formulated to placate political opposition to the government of Abdou Diouf, president since 1981. The legislation provided for the transfer of significant powers to local government through decentralisation and devolution, and promoted citizen participation and regional planning. The rhetoric articulated the principle of subsidiarity, bringing government closer to the people. Furthermore, Article 58 of Law 96-07 stipulates that no function should be transferred to local government without the transfer of adequate resources, provided by receipts from certain types of tax, grants or both. This has never been the case for Dakar. The state has routinely withheld funding from municipalities, particularly those in the hands of opposition parties. Erratic, arbitrary and non-transparent financial transfers are a feature of Senegal’s decentralisation that severely undermines its stated purpose.

In Dakar, the continued predominance of the state is personified administratively by the government appointed préfet du département de Dakar and fiscally by the percepteur, in effect the city’s external accountant. Both are empowered to intervene in, as well as oversee, city administration; but the city of Dakar has no mechanism to force central government to pay its dues. Several initiatives set up by the state to increase local authority financing have not been successful. Allowances to Dakar, ostensibly to fund the functions transferred by decentralisation, averaged a paltry FCFA322m (US$650,000)3 per annum in 2008-12, less than 1% of the city’s budget.

Without the regular transfer of the resources to which it is legally entitled, Dakar cannot fulfil all its devolved responsibilities, which are significant.4 There is limited scope to increase resources by improving local revenue collection because taxation is highly centralised. Although the city succeeded in increasing its own revenues by almost 40% in 2008–12, it has control over less than 10% of its total revenue, mostly generated from fees for advertising billboards. After two decades decentralisation has yet to deliver what it originally promised to the residents of Dakar.

The framework of decentralisation creates considerable overlap between national and local government systems. While relations on a day-to-day basis are mostly harmonious, a “confusion of powers”5 frequently complicates or frustrates local planning and administration. Ambiguity in the definition of responsibilities is a key stumbling block to more effective collaboration between central and municipal governments in Dakar.

Dakar invests

Khalifa Sall was determined that the city council should gain credibility for competent administration and not be reduced to inaction by financial limitations. “We took the decision at the outset to invest the city’s resources, such as they were, in all functions we are responsible for – social, cultural, sport and others”, the mayor told ARI.6 Early initiatives in education included a school milk programme, free school uniforms and computers for elementary schools, and free annual medical examinations for children. Major public works involving the “Dakar volunteers” programme for unemployed youth included paving and sand clearance from the city centre.

Sall sought funding wherever he could. He was helped by Dakar having undergone a Public Expenditure and Financial Accountability (PEFA) review of its financial management system with a view to accessing loans and other external finance.7 T he city was the first subnational entity in Africa to be assessed in this way and its performance was mixed. The review judged that Dakar “[did] not have a programme of reforms, still less a programme of the management of public finances”8. Inadequacies in planning and forecasting were highlighted. Nevertheless, PEFA provided the impetus for improvements, for example in accountability, by making audits and evaluations public. Reforms were sufficient to enable Dakar to borrow. A €10m (US$16m) 20-year concessional loan had already been secured from Agence Française de Développement in 2008 to pay for street lighting improvements. Under Sall, commercial loans were approved: FCFA3.6bn (US$7.2m) from Ecobank to rebuild a downtown market; a three-year FCFA2.1bn (US$4.1m) loan from Banque Islamique du Sénégal for traffic lights; and FCFA9.7bn (US$19.5m) from the West African Development Bank for road rehabilitation and parking. To date, debt service and repayments of these loans have been made on time.

“We learned from the experience of investing in traffic lights, roads and pavements,” says Khalifa Sall. “Next, we decided we would undertake a real poverty reduction project”. A major investment in a 10ha commercial zone in Petersen, at the northern extremity of Dakar- Plateau municipality, was planned. As part of a strategy to reorganise the city centre, the zone included a new FCFA13bn (US$26m) market with affordable space and facilities for 4,000 or more of the city’s marchands ambulants – street vendors – and shopkeepers. The mayor banned street trading, a controversial move, but held frequent consultations with trader associations to explain his plans and hear objections. Although “poverty reduction, with the street vendors” is the objective, relations between the city authorities and marchands ambulants remain volatile and at times acrimonious.

If many of the marchands ambulants of downtown Dakar could be concentrated in a single location, there was another potential benefit. It would decongest Dakar-Plateau and the southernmost part of the peninsula. The World Bank estimates that Dakar’s traffic congestion, exacerbated by unregulated street trading, costs FCFA108bn (US$216m) in lost income a year. The project would also generate much-needed revenue for the city, reducing its financial dependency on the central government. The challenge was raising the required FCFA20bn (US$40m). In 2012, Dakar’s operating revenues were FCFA36.5bn (US$73m) and its capital expenditure FCFA11bn (US$22m).

Going to the market

Sall’s plans were drawn up against a backdrop of immense political turmoil in the run-up to Senegal’s 2012 presidential election. “From day to day, the mayor didn’t know if he’d be thrown in jail [by Wade]. Or if mayors would be abolished altogether,” says Khady Dia Sarr, director of the Dakar Municipal Finance Programme (DMFP), a team of four Senegalese professionals and one external expert established in the mayor’s office.9 Although alternatives existed, the attractions of issuing a municipal bond were clear. It would enable the city to borrow a large amount in a lump sum and at a cheaper rate than commercial borrowing. It would also signal a determination by the city not to rely on concessional financing and confidence in its ability to manage a large revenue-generating investment. Preparation for a bond issue “was a whole new process” for the mayor, DMFP and the city administration, according to DMFP’s co-ordinator Dieynaba Dabo. “No one knew exactly what to do.” Having finalised its plan in May, DMFP was officially launched in September 2012.

In most African countries sub-national entities are not allowed to borrow. Few municipalities are able to establish creditworthiness based on cash flow, debt profile and credit history to allay investor concerns about repayment of the loan. Few can show an adequate record of strategic planning, debt management and competent administration. In this context, Dakar was no different to most African capitals. Its self-generated income and resources were slight, its budget was substantially dependent on central government and its technical capacity limited. But following the PEFA assessment the city had established a Department of Planning and Sustainable Development (DPDD) capable of demonstrating that Dakar had a credible development strategy; and it had a short record of competent debt management.

The preparation for a municipal bond issue is crucial. The mayor and DMFP had to make cautious council members and the city’s finance, administration and planning departments feel involved and fully consulted. A new consultative council was established, which included civil society, business representatives and religious leaders. Small initiatives professionalised city administration and bolstered the expertise of the DPDD, to enhance Dakar’s strategic plan, the Department of Administration and Finance, to maximise revenue collection, and the Department of Urban Development, to help with the design and construction of the investment project.

The regulatory framework also had to be navigated: the bond needed to comply with the requirements of the issuing authority, WAEMU’s Conseil Régional de l’Épargne Publique et des Marchés Financiers (CREPMF), with headquarters in Abidjan, Côte d’Ivoire. Early in 2014, a World Bank team followed up on the PEFA review and advised the city on implementing further improvements in its fiscal revenue management. A successful issue is dependent on a credible investment plan, proactive communications and good timing.

Dakar rated… and blocked

At the outset, international ratings agency Moody’s was commissioned to provide a confidential credit rating for Dakar. The process appraised, among other things, the quality of the city’s decision making, budgetary planning, asset and debt management, and the predictability of revenues. The rating provided a benchmark against which improvements could be made before obtaining an official, public rating. Given that the bond would be launched in the WAEMU regional market, Bloomfield a ratings agency, based in Côte d’Ivoire and accredited by CREPMF, was selected.

In September 2013, after a rigorous three-month re-examination of its finances, Dakar received an A3 short-term rating and BBB+ long-term rating. Although this investment-grade rating would have been sufficient under the regulator’s guidelines for bond issuance, the city secured a partial guarantee for 50% of the principal amount of the bond from the United States Agency for International Development (USAID) to further enhance the transaction’s creditworthiness. Jeremy Gorelick, lead technical and financial adviser to DMFP, commented that “the presence of a credit enhancement from a well-respected guarantor like USAID helped to relieve some of the concerns about worst-case default scenarios.”

Once the city received its rating, the bond could be structured. The loan amount was set at FCFA20bn(US$40m) to be repaid after seven years. Annual interest of 6.6% was offered to investors. For the first two years none of the principal amount of the loan would be repayable, but USAID stipulated a reserve fund to finance the first such repayments. A Dakar-based firm was mandated to arrange the marketing and placing of the bond through 18 financial intermediaries in the eight WAEMU countries. In January 2015, after delays partly caused by the 2014 local elections, the launch of the bond on Abidjan’s Bourse régionale des valeurs mobilières, the regional securities exchange, was imminent. Press coverage and a regional investor roadshow began. Investor demand was reported as strong and in February CREPMF issued the visa authorising the issue to proceed.

Two days before the official launch date, Senegal’s ministry of the economy and finance suspended a written avis de non-objection it had given to the project in July 2014, presenting certain “technical objections” that blocked the bond issuance. Concerns and questions were raised about the city’s level of indebtedness; the potential liability of the state in the event of default for the 50% of the issue not covered by USAID’s guarantee; the political affiliation of the real estate developer who stood to benefit from the construction of the new Petersen commercial zone; and the legality of the issue under Act III of decentralisation. On 5 March, CREPMF withdrew the visa for the bond.

Khalifa Sall responded that nothing had changed since the government had given its permission to proceed. The préfet and the percepteur, an appointee of the ministry of the economy and finance, had approved the general and budgetary legality of the issue. Many of the mayor’s allies saw the block as being directed at Khalifa Sall personally. In the 2014 local elections he defeated the prime minister, Aminata Touré, put up as a candidate by the government to unseat him and win control of the capital. With the possibility of the mayor standing for the presidency against Macky Sall appearing more likely after he secured a second term as mayor, the influence of national politics on the management of Senegal’s capital was once again confirmed.

Funding Africa’s urbanisation

To date, rapid urbanisation has not been a key driver of economic growth in sub-Saharan Africa. It is characterised by the proliferation of unplanned slums devoid of basic service provision, spiralling youth unemployment, and escalating environmental hazard and degradation. The overwhelming majority of residents of most cities and their informal economic activity, on which a more prosperous future depends, are largely ignored by government master plans. There is a chronic shortfall in urban financing.

A 2012 study estimated Africa’s “municipal investment gap” at US$25 billion per annum. The report observed that “despite this pressing need most African local governments have limited access to capital markets and no private sector finance for infrastructure”.10 Diversification of funding is urgently required. Africa’s cities cannot continue to rely on inadequate handouts from central government and limited donor-funded concessional finance. Greater financial autonomy is a necessity. The crucial role of local governments in achieving the Sustainable Development Goals (SDGs) was recognised in the 2015 Addis Ababa Action Agenda; and it will be re-emphasised by the Habitat III global summit in October 2016.

Dakar showed an active, innovative approach to its funding requirements. Led by a dynamic, competent mayor the attempt to make a substantial pro-poor, revenue-generating investment funded by a municipal bond has much to teach other cities. DMFP was very much an indigenous initiative. The preparation for the bond issue did not require armies of external technocrats; a core of competent municipal administrators was sufficient, supported by external development finance institutions where necessary. Key city departments were required to carry out a few basic functions better and this was achieved through planning, communication and collaboration. By taking the city to the point of launching its bond, DMFP also highlighted the potential for bolstering municipal finance in Africa.

There is considerable scope for better tax administration by or on behalf of cities, improvements in revenue generation and cost control. For example, in Dakar the city administration could readily improve on inefficient central government collection of local taxes under a revenue-sharing agreement; and property tax has been seriously neglected as a source of municipal income.11 Existing regional bond markets are the foundations for municipal and state bond issuance in local currencies to African investors, but they could be bolstered by a more developed, affordable domestic credit ratings industry. Further development of the regulatory framework in regional bond markets would boost investor confidence and facilitate domestic mobilisation of more of Africa’s financial assets.

The human and economic resources of Dakar’s city administration are no greater than those of most African capitals. Its financial history was imperfect. Yet the city succeeded in building a convincing argument for its creditworthiness and crafting a bankable transaction that significantly exceeded standard debt service ratios for municipalities. These factors, combined with the USAID guarantee, attracted the core group of investors prepared to commit to investment. In December 2014, DMFP was awarded the Prix Guangzhou, initiated in 2012 by UCLGA and the city of Guangzhou. Dakar’s project was the only one from Africa in a field of 259 entries.

Like many capitals, Dakar is in fact two cities. A central government volte-face that subverted Dakar’s bond issue at the eleventh hour underscored that it is a fiercely contested political prize as well as being the direly underfunded centre and hub of Senegal’s economic activity. This duality has proved a significant obstruction to economic and social development in many capitals worldwide. But in Africa the need to circumvent it is particularly pressing. If urbanisation is to become an engine for development, collaboration and development will have to be prioritised over party politics – a complex and fraught transition to achieve anywhere.