Independent power projects (IPPs) can contribute to economic growth and livelihood improvement – when they are competitively and transparently negotiated within effective energy planning and regulatory systems. By contrast, unsolicited and non-competitive projects can end up costing percentage points of gross domestic product (GDP). Tanzania’s experience with IPPs since the mid-1990s falls into the latter category.

Framed as an “emergency” supplier to address an energy crisis in 1994-95, Independent Power Tanzania Ltd (IPTL) did not serve the national grid until 2002. It then became a permanent feature of the energy sector for the next 15 years. In the process, the facility burdened the Tanzania Electric Supply Company (TANESCO) with overpriced, diesel-fuelled power that was not part of the country’s “least cost” strategy, while seriously undermining the development of gas-fuelled power that was. To make matters worse, a second “emergency” project known as Richmond – later Dowans and finally Symbion – failed to address another energy crisis in 2006, and remained idle for two years after its eventual completion, while still collecting capacity charges of US$4m a month. Finally, an escrow account, set up in the central bank to hold monies owed by TANESCO to IPTL while a dispute between the two parties underwent arbitration, was paid to the new “owner” of the facility in suspicious circumstances. This led to further litigation and, in July 2017, the arrest of the principals involved on charges of fraud and criminal conspiracy.

Framed as an “emergency” supplier to address an energy crisis in 1994-95, Independent Power Tanzania Ltd (IPTL) did not serve the national grid until 2002. It then became a permanent feature of the energy sector for the next 15 years. In the process, the facility burdened the Tanzania Electric Supply Company (TANESCO) with overpriced, diesel-fuelled power that was not part of the country’s “least cost” strategy, while seriously undermining the development of gas-fuelled power that was. To make matters worse, a second “emergency” project known as Richmond – later Dowans and finally Symbion – failed to address another energy crisis in 2006, and remained idle for two years after its eventual completion, while still collecting capacity charges of US$4m a month. Finally, an escrow account, set up in the central bank to hold monies owed by TANESCO to IPTL while a dispute between the two parties underwent arbitration, was paid to the new “owner” of the facility in suspicious circumstances. This led to further litigation and, in July 2017, the arrest of the principals involved on charges of fraud and criminal conspiracy.

This Briefing Note chronicles how politics and rent-seeking have subverted the development of Tanzania’s power sector during the past quarter of a century and offers tentative estimates regarding the extent of the irreparable damage caused.

South-South cooperation trumps the World Bank

The IPTL saga began during the presidency of Ali Hassan Mwinyi (1985-95). In 1992, the Government of Tanzania published a national energy policy [1] favouring the development of power generation using natural gas from the Songo Songo offshore field (see Appendix). Reducing dependence on unreliable hydropower and imported diesel was a key objective of this least cost expansion plan. But while the government engaged in discussions with Canadian company Ocelot to develop the natural gas project (“Songas”), it received an unsolicited proposal from Mechmar Corporation (Malaysia) to finance and build an emergency diesel-fuelled power plant to help mitigate the power-rationing crisis in 1994-95.

Like many other companies, Mechmar rode on the diplomatic coattails of Malaysian Prime Minister Mahathir Mohamed (1981-2003), who spearheaded national investments in utilities, telecoms and real estate across Africa during the 1990s, under the banner of “South–South cooperation”.[2] Despite not being in line with the government’s official least cost power strategy, Mechmar and the government signed a 20-year power purchase agreement (PPA) in May 1995. By then, the power crisis had come and gone. Meanwhile, Songas was to encounter one bureaucratic hurdle after another.

IPTL’s local partner and 30% shareholder, VIP Engineering and Marketing, a Dar es Salaam-based concern owned by Tanzanians of Asian descent, secured official endorsement for the deal. VIP director (and later owner) James Rugemalira fended off strong opposition to IPTL from within the Ministry of Water, Energy and Mineral Resources by playing the South–South card and, crucially, bribing senior officials and politicians.[3] The contract breached the government’s covenant under the World Bank-funded Power VI Project that it would not procure major power generation projects without consent. In July 1997, the Bank – the main financier of Songas[4] – suspended further support until the government dealt with the potential threat IPTL posed to the financial viability of TANESCO.

Among other things, TANESCO accused IPTL’s owners of significantly overpricing the plant and substituting cheaper medium-speed generators for slow-speed generators specified in the PPA.[5] In 1999, the dispute was taken to the International Centre for Settlement of Investment Disputes (ICSID) for arbitration. More than three years later, during which Tanzania endured further shortages of power due to the continued dependence on hydropower, ICSID finally assessed the real cost of IPTL at US$127.2m, compared to the original US$150.7m.[6] Without the tenacity of the permanent secretary at the Ministry of Water, Energy and Mineral Resources, Patrick Rutabanzibwa,[7] Mechmar would also have saddled TANESCO with substantially higher monthly capacity charges. ICSID reduced these from US$4.5m to US$2.6m a month.[8]

From 2002, instead of having a short-term emergency facility in IPTL, Tanzania was shackled for the next 15 years by an overpriced power plant running virtually full-time on imported (and overpriced) diesel fuel. The planned generating capacity of Songas was downsized and its commissioning further delayed to 2004. Even so, commissioning IPTL and Songas within two years of each other added about 40% to existing installed capacity, giving Tanzania considerably more power than it needed.[9] A further round of arbitration initiated by TANESCO on the grounds that IPTL was still overcharging, another emergency power scandal and the contested acquisition of the IPTL plant ensued. The creation of IPTL presaged what was in effect the takeover of energy planning and project development in Tanzania by private interests.

In 2006, just four years after IPTL began commercial operations, Richmond Development Company won a tender to generate 120 megawatts (MW) of gas-fired electricity for an investment of US$123.2m. This second emergency power supplier resembled IPTL in its excessive cost and the methods its sponsors used to subvert the project evaluation, selection and negotiation process.[10] In November 2006, the government prevented TANESCO from terminating the Richmond PPA for non-performance. By the time the Richmond plant in Ubungo was commissioned in 2007, the power shortage it had been supposed to address had passed as a result of above average rainfall. Tanzania was nevertheless legally committed to buy its power or incur penalties.

A parliamentary select committee set up in 2008 to investigate growing suspicions of malfeasance expressed in the media and the National Assembly revealed that Richmond was a shell company with no power generation experience; that the tender was fixed; and that the delays in commissioning were in large part the result of the company’s inability to finance the procurement and transport of the generators, and technical hitches with their installation. It was further revealed that Richmond had been taken over in late 2006 by Dowans Holdings, an entity based in the United Arab Emirates.[11] After the plant was commissioned, it remained idle for two years but continued to earn its owners capacity charges of about US$4m per month.

These revelations prompted the resignations in February 2008 of Prime Minister Edward Lowassa and Minister of Energy and Minerals Nazir Karamagi. But that was not the end of the fiasco. Dowans took TANESCO to arbitration at the International Chamber of Commerce and, in 2010, was awarded US$65.8m (plus interest) for breach of contract for non-payment of capacity charges. In March 2017, Symbion Power, the current owner of the plant, went to the same arbitration body to claim US$561m from TANESCO for breach of contract, power supplied and not paid for, and other monies owed.

Part two of the IPTL saga came to be known as “Escrow”. In 2007, TANESCO requested arbitration from ICSID for a second time, again maintaining that IPTL was overcharging for electricity. The claim was based on the failure of VIP to pay up its 30% equity stake in the company.[12] It took the best part of seven years for ICSID to reach a decision. In the meantime, capacity charges payable by TANESCO to IPTL were held in escrow at the Bank of Tanzania, in the so-called Tegeta Escrow Account (TEA). Finally, in February 2014 ICSID upheld TANESCO’s claim and instructed Standard Chartered Hong Kong – the owner of IPTL’s debt since the company had gone into receivership in 2005 – and TANESCO to agree on how much the utility had been overcharged. However, by the time the ruling was made IPTL was under new ownership and more than half of the money held in escrow had already been paid out to IPTL’s new owner, Pan African Power Solutions (PAP), owned by Harbinder Singh Sethi.[13]

Revelations of the extent of foul play involved in the transfer of ownership of IPTL to PAP and the withdrawal of funds held in the TEA filled the Tanzanian media during most of 2014. The scandal was revealed by the Parliamentary Public Accounts Committee (PAC), chaired by opposition MP Zitto Kabwe,[14] and a series of investigative articles in The Citizen newspaper. Kabwe instructed the Prevention and Combating of Corruption Bureau and the Controller and Auditor General’s Office, Tanzania’s supreme auditor, to investigate.[15]

Among other things, the public learned much about Sethi, a Tanzanian-born “tycoon” in his sixties who made his fortune in Kenya as a building contractor during the presidency of Daniel arap Moi (1978-2001).[16] He had acquired Mechmar’s notional 70% shareholding in IPTL[17] through an elaborate scheme that involved a Mechmar director, an intermediary based in the British Virgin Islands, and payment of the astounding sum of US$75m to Rugemalira for his 30% shareholding, using part of the first tranche of the TEA funds released to him.[18] To do this necessitated bribing senior politicians and government officials, regulators, judges, lawyers and bankers. Rugemalira was subsequently shown to have made payments of up to US$1m each to a long list of senior officials, including former Attorney General Andrew Chenge, a key facilitator of IPTL since its inception.[19] In late 2014, despite overwhelming evidence in the public domain of malfeasance on the part of Sethi and Rugemalira, President Jakaya Kikwete (2005–2015) in effect endorsed the looting of the TEA by settling for a few symbolic resignations and minor prosecutions.[20]

While IPTL has benefitted individuals connected to Mechmar, VIP and PAP, and a few senior Tanzanian politicians and government officials, the direct and indirect costs of the scam have been borne by all power consumers, actual and potential, and Tanzanians at large. Its consequences have included overpriced electricity, avoidable power crises, the subversion of planning for timely and appropriate expansion of the energy sector, and TANESCO’s insolvency. Not all are precisely quantifiable.

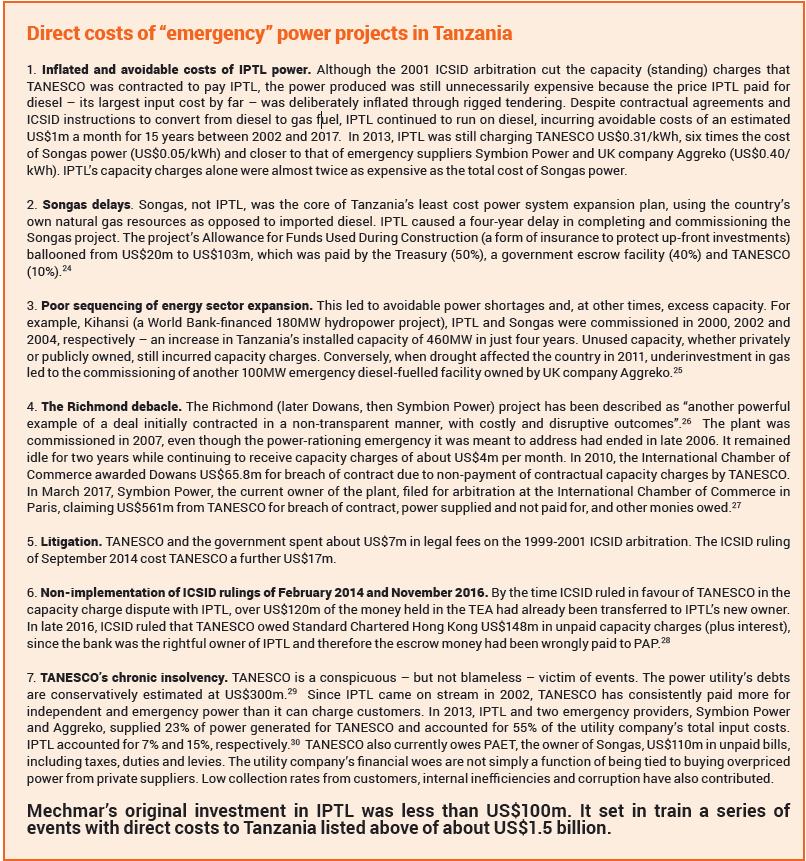

The box (“Direct costs of “emergency” power projects in Tanzania”) shows the direct costs to Tanzania incurred as a result of IPTL and other “emergency” power projects.

The sum of the direct costs of emergency power projects, though substantial, is almost incidental when compared to the indirect costs to Tanzania. These are harder to quantify precisely, but the order of magnitude starts to become apparent when collating relevant sources and occurrences. For example:

- According to a World Bank estimate, the cost of power outages to the Tanzanian economy in 2005 – a single year – was 4% of GDP, or nearly US$2 billion.[21]

- The price of the delay in pursuing and expanding the least cost strategy is discernible from the claim made by PanAfrican Energy Tanzania (PAET, not to be confused with PAP), the owner of Songas, that the partial use of natural gas instead of imported diesel has saved Tanzania more than US$6.2 billion since 2004.[22]

- In 2014, international donors withheld budget support worth over US$500m in protest at the Escrow scandal. Negotiations for a second US government Milennium Challenge Account grant worth US$450m, largely earmarked for power generation, were suspended. The grant was eventually cancelled over the annulled Zanzibar elections in 2015.[23]

It is even more difficult to be precise about the most significant cost of all, that of economic growth, employment and opportunities to improve welfare foregone. A more efficient, least cost power supply in Tanzania would have generated income from power sales, which could have been used to extend the grid for the benefit of commercial and domestic users alike and leverage private investment in new power plants. Instead, while big companies could install costly standby generators that mostly ran on imported diesel, countless small manufacturers and service providers were simply forced to close down.

A 2016 World Bank study of IPPs in five countries in sub-Saharan Africa concluded, “the lessons from Tanzania’s experience with IPTL could not be more explicit: when power is not planned and procured transparently and consistently, the implications are potentially grave, far-reaching and on-going”.[31]

Numerous surveys have reported availability and cost of electricity as major constraints on “doing business”, investor confidence and competitiveness in Tanzania. In 2006, 88% of Tanzanian firms cited inadequate electricity as a key hindrance to their operations, placing Tanzania 122nd out of 139 countries surveyed.[32] According to a report published by the government and the United States Agency for Development in 2011, “Tanzania’s well documented electricity problems [are] by far the most important infrastructure constraint to investment and economic output”.[33] A 2013 World Bank Enterprise Survey estimated power outages in Tanzania cost businesses about 15% of annual sales. In 2016, a report by CDC Group and the Overseas Development Institute found that in Tanzania and other African countries, “both GDP and formal private sector employment were closely and positively correlated with increased supply and consumption of electricity”.[34] As a result of poor planning and regulation, vested interests and the other factors described in this note, only 20% of Tanzanians have access to electricity compared to a median of 34% for sub-Saharan Africa.[35]

The World Bank and international development agencies have promoted IPPs as a means of mobilising private capital to build and manage power plants. Such arrangements have had positive results in a number of countries, including Kenya, whose power utility KenGen makes profits and distributes dividends, despite numerous cases of corruption.[36] While Kenya started developing geothermal power within a decade of its discovery, Tanzania took two decades to begin exploiting its natural gas deposits – and increasing the supply of gas to keep up with the growing demand for power is by no means guaranteed.[37]

In 2011, the government negotiated an expansion of Songas with owner PAET to meet the ever-growing demand for power. But the launch of the National Natural Gas Infrastructure Project (NNGIP) drew the policy focus away from the short-term development of Songas to long-term development of the gas sector. Not for the first time, the privately funded Songas expansion was put on hold. NNGIP included the construction of a 532km pipeline from Mtwara to Dar es Salaam, at a cost of US$1.2 billion, financed by China’s Exim Bank.[38] Completed in early 2015 the new pipeline has been functioning at a maximum 4% of capacity. The use of emergency power providers continues.

Between 2010 and 2014 new offshore deposits of natural gas were discovered, vastly increasing the extent of Tanzania’s known offshore reserves to 57 trillion cubic feet. While leading politicians and planners are pinning their hopes for economic development on the construction of a liquefaction plant, which will cost up to US$30 billion, the country’s poor regulatory record and trends in global fuel prices make it unlikely that these hopes will be realised any time soon.[39] Meanwhile, chronic gas shortages undermine the rationale for the massive planned expansion of gas-fuelled power plants.[40]

A modest 100MW power plant should not have the potential to derail a nation’s energy policy, render its electricity utility insolvent, and trigger repeated power crises with massive knock-on effects on industrial, commercial and domestic electricity consumers. Yet that is what IPTL has managed to achieve in Tanzania since 1994. While IPTL cannot be held responsible for all the woes of Tanzania’s energy sector, it is by far the largest single cause.

The absence of robust regulatory and oversight institutions in Tanzania allowed corrupt politicians and officials to ride roughshod over formal energy planning and project management procedures. Most of the critical commentary on IPTL and subsequent Richmond and Escrow scandals have highlighted the corruption dimension. This misses the main point. Corrupt rent-seeking in public procurement and contracting is widespread in countries much more developed than Tanzania, but not all rent-seeking has equally devastating economic and financial consequences.

If one small power plant can undermine the entire energy sector and cost percentage points of GDP, then such rent-seeking has the potential to permanently compromise the entire economy, limit growth and impede employment creation. While “smart” corruption might involve taking a one-off cut on a justifiable project that is required by official policy, generates employment, is productive and contributes to government revenue, “dumb” corruption derails key national policies and imposes huge additional recurrent costs on end users, taxpayers and international donors.[41]

On 19 June 2017, Harbinder Singh Sethi and James Rugemalira were arrested and charged with economic sabotage, criminal conspiracy, money laundering and numerous other offences. If convicted, they could face long jail terms. Their arrest was a dramatic and unexpected development, since both men had enjoyed a privileged relationship with powerful and influential figures in government, in Rugemalira’s case for almost 25 years. The charges relate specifically to Sethi’s controversial acquisition of the IPTL plant in 2013 and consequent looting of the TEA, not to the origins and negative impact of IPTL over the years.[42] Cynical observers had been arguing that President John Magufuli’s aggressive anti-corruption policy was selective in that he avoided “sensitive” issues such as IPTL and Escrow, in which his predecessors were implicated.[43] The arrest of Sethi and Rugemalira may prove the cynics wrong.

For more than three years since the Escrow scandal broke, IPTL has been able to continue reaping the spoils. It may not survive much longer. In August 2017, Magufuli ordered the Energy and Water Utilities Regulatory Authority to stop negotiations over an extension to IPTL’s contract with TANESCO.[44] Any satisfaction at this news needs to be tempered by the fundamental lesson of the IPTL saga, emergency power provision and deficient energy policy formulation in Tanzania. Namely, that the costs to the Tanzanian public far exceed the sums made by a few opportunistic rent-seekers.

Brian Cooksey is an independent consultant based in Tanzania. He has been monitoring IPTL since 1997

Notes

[1] United Republic of Tanzania (1992), The Energy Policy of Tanzania, Ministry of Water, Energy and Minerals.

[2] As chairman of the South Commission, former Tanzanian president Julius Nyerere was sympathetic to the “delinking” of Africa from Western economic domination (see South Commission (1990) The Challenge of the South, Oxford: Oxford University Press). When apprised of the nature of IPTL, however, he declared that colonialism was preferable to such “South–South cooperation.” The promoters of IPTL used anti-World Bank rhetoric to counter their critics. See Cooksey, Brian (2002) “The Power and the Vainglory: A $100 million Malaysian IPP in Tanzania” in Jomo, KS (ed.) Ugly Malaysians? South-South Investments Abused, Institute for Black Research, Durban.

[3] Evidence of bribery by Rugemalira was contained in affidavits by three government officials presented to ICSID in 1999. For details see: Cooksey (2002); and Kabwe, Zitto (2014) “How PAP acquired IPTL for almost nothing and looted US$124m from the BoT”, https://escrowscandaltz.wordpress.com/

[4] The US$266m Songas project included a 225km pipeline to Dar es Salaam, fuelling a 115MW power plant, and other engineering components. The World Bank provided US$100m, Swedish International Development Cooperation Agency (SIDA) and the European Investment Bank a further US$106m of concessional finance, and private equity investors US$60m (Gratwick, Katharine; Ghanadan, Rebecca; and Eberhard, Anton (2007) “Generating Power and Controversy: Understanding Tanzania’s Independent Power Projects”, Management Programme in Infrastructure Reform and Regulation Working Paper, Graduate School of Business, University of Cape Town). Concessional lenders and private investors changed substantially before Songas was commissioned.6

[5] Overcharging included infrastructure and staff houses that had not been constructed. There is substantial evidence that Wärtsilä, the Finnish company that built and later ran the plant, was complicit in the overcharging. See Cooksey (2002) for details.

[6] US$163m if the price of conversion from diesel to gas-firing (which was envisaged in the PPA) is included (Eberhard, Anton; Gratwick, Katharine; Morella, Elvira and Antmann, Pedro (2016:208) Independent Power Projects in Sub-Saharan Africa, Lessons from Five Key Countries, World Bank, Washington DC.

[7] Cooksey (2002) relates how Rutabanzibwa fought a losing battle against politicians over the relative merits of Songas and IPTL. During one Cabinet meeting, he unsuccessfully challenged the attorney-general’s support for IPTL. Without Rutabanzibwa’s insistence, there would probably have been no arbitration over the inflated cost of the plant.

[8] Capacity charges were calculated on the basis of the actual cost of building the plant. The PPA required the plant to be ready to provide power at short notice, failing which penalties would be incurred. The main running cost was fuel to power the generators. Both capacity charges and the cost of fuel proved contentious.

[9] Eberhard et al. (2016:208-9) “As a result, Tanzania found itself overcommitted in terms of capacity; the country needed at the most one plant, but certainly not two”. The literature is unclear on why, if IPTL plus Songas constituted excess capacity, there was another power crisis only two years after the commissioning of Songas.

[10] Richmond turned out to be a “special purpose vehicle” with no experience of power generation. The report of the Parliamentary select committee chaired by Dr Harrison Mwakyembe MP asserted that: “The proprietors of Richmond are Prime Minister Lowassa and his close friend (Igunga MP) Rostam Aziz.” Lowassa denied the claim, although he resigned. Aziz subsequently withdrew from what he termed “dirty” politics. See Tanzanian Affairs (2008) “Report on Richmond Scandal”, April.

[11] Although of unclear ownership, Dowans was shown by the committee to be represented in its Tanzanian subsidiary by Rostam Aziz, a wealthy Tanzanian businessman and ruling Chama Cha Mapinduzi party MP (1993-2011), central committee member (2006-2011) and national treasurer (2005-2007).

[12] ICSID determined in the first round of arbitration that the actual cost of the IPTL plant was US$127.2m. This was divided 70:30 between Mechmar and VIP. Mechmar’s investment consisted entirely of debt, valued at US$89.04m. VIP’s investment was the remaining US$38.16m, which the company claimed was contributed “in kind”, rather than as equity (Eberhard et al. 2016:219). TANESCO therefore argued that the monthly capital (“capacity”) charge should be revised downwards since the actual construction cost of the plant was 30% lower than the ICSID estimate. For comparison, Songas was also financed 70:30 through debt and equity, but the 30% equity was fully paid up by the private investors.

[13] See Kabwe (2014) and Policy Forum (2015 and 2017) Tanzania Governance Review 2014 and 2015-2016 for details of the controversial acquisition of IPTL and the looting of the TEA.

[14] Tanzania follows the British system of appointing opposition MPs to head the PAC. At the time a member of opposition party Chama cha Demokrasia (CHADEMA), Zitto Kabwe later resigned and founded his own party, the Alliance for Change and Transparency.

[15] The Bureau’s report was never published, probably because it implicated State House officials and relatives of Kikwete.

[16] According to the leaked Kroll Report, Sethi co-owned controversial IPP Westmont Power (Kenya) Ltd with Nicholas Biwott, a close associate of President Daniel arap Moi. Sethi was also said to manage a large property portfolio in South Africa on behalf of Moi’s son, Gideon.

[17] “Notional” since Mechmar was in receivership when Sethi acquired the shares and Standard Chartered Hong Kong purchased the debt incurred in building IPTL, as described above; see Africa Confidential (2014), “Power fraud unravels”, Vol. 55 no.19, 26 September.

[18] This payment theoretically valued IPTL at US$250m. Sethi’s total outlay to acquire Mechmar’s 70% shareholding was not more than a few million US dollars. See Kabwe (2014).

[19] See Cooksey (2002), inclduing for evidence of Chenge’s role in facilitating the official endorsement of IPTL in 1994. See also Policy Forum (2017) Tanzania Governance Review 2015–16: From Kikwete to Magufuli: Break with the past or more of the same? for evidence of Chenge’s continued collaboration with Rugemalira at the time of “Escrow”.

[20] See Table 1, Policy Forum (2016) Tanzania Governance Review 2014: The year of ‘Escrow’. In a long and convoluted speech to Dar es Salaam elders and others, Kikwete repeated the rather lame argument that the TEA money was “private” rather than “public”. The next day’s headline news was the sacking of Minister of Lands Anna Tibaijuka, a relatively minor player in the Escrow drama, although she received the equivalent of US$1m (TShs1.6 billion) from Rugemalira.

[21] Eberhard, Anton; Rosnes, Orvika; Shkaratan, Maria and Vennemo, Haakon (2011:11) Africa’s Power Infrastructure: Investment, Integration, Efficiency, World Bank, Washington DC.

[22] The Citizen (2017) “Relief as Tanzania saves Sh14tr by extracting Songo Songo gas”, 10 August; The Guardian (2017) “Songo Songo gas project prevails over operational hitches to deliver innumerable benefits and savings”, 15 August.

[23] In 2008, the Millennium Challenge Corporation and the Government of Tanzania signed a five-year US$698m compact to finance roads, power and water supply.“

[24] Eberhard et al. (2016:202-210).

[25] BBC News (2011) “Power firm Aggreko wins £23m Tanzania contract”, 22 June.

[26] Eberhard et al. (2016: 217).

[27] Tanzania Invest (2017) “Symbion power claim US$561m to Tanzania Electric Power Company”, 29 March.

[28] Law360 (2017) “ICSID pauses enforcement of US$148m award against Tanesco”, 13 April.

[29] Bloomberg (2016) “Tanzania power issues casts shadow on $12 billion debt plan”, 16 February.

[30] Eberhard et al. (2016:202).

[31] Eberhard et al. (2016:91).

[32] World Economic Forum survey, cited in World Bank (2013:102) Enterprise Survey: Tanzania.

[33] Governments of the United Republic of Tanzania and the United States of America (2011:102) Tanzania Growth Diagnostic: Partnership for Growth. CDC and Overseas Development Institute (January 2016:1) “What are the links between power, economic growth and job creation?”, Development Impact Evaluation Evidence Review: “in Tanzania and other African countries both GDP and formal private sector employment were closely and positively correlated with increased supply and consumption of electricity”.

[34] CDC/ODI op.cit.

[35] Kojima, Masami and Trimble, Chris (2016) Making Power Affordable for Africa and viable for its utilities, World Bank, Washinton DC; Eberhard et al. (2016) claims that Tanzanian access to power is about average for sub-Saharan Africa.

[36] For a comparison between TANESCO and KenGen, see Policy Forum (2016: Chapter 4); also Daily Nation (2015) “Increased power sales sees KenGen post Sh11.5bn net profit”, 14 October.

[37] Daily News (2015) “Kenya’s geothermal overtakes hydro before completion of plant”, 22 October.

[38] Opposition MP Zitto Kabwe claimed there was massive corruption involved in the pricing of the pipeline.

[39] “Tanzanian LNG, which has already suffered delays relating to land acquisition and regulatory uncertainty, may slip further down the lengthy waiting list of… LNG project(s).” See The East African (2017) “Uncertainty clouds Tanzania gas investment as low prices persist”, 23–29 September. See also Policy Forum (2015:54-56) Tanzania Governance Review 2013: Who will benefit from the gas economy, if it happens”.

[40] Eberhard et al. (2016:213) lists planned state-owned and public-private partnership gas-powered projects costing over US$1.4bn to generate 1,240MW of electricity.

[41] This is an important distinction that helps explain why some countries – China, for example – develop rapidly despite widespread corruption.

[42] Cooksey, Brian (2017) “Focus should now turn to IPTL, they created Escrow”, The East African, 24 June

[43] IPTL was conceived during the “second phase” government of President Ali Hassan Mwinyi, commissioned during President Benjamin Mkapa’s decade in power (1995–2005) and survived intact, including Escrow, under President Jakaya Kikwete (2005–2015).

[44] Daily News (2017) “IPTL’s licence extension flops”, 31 August.

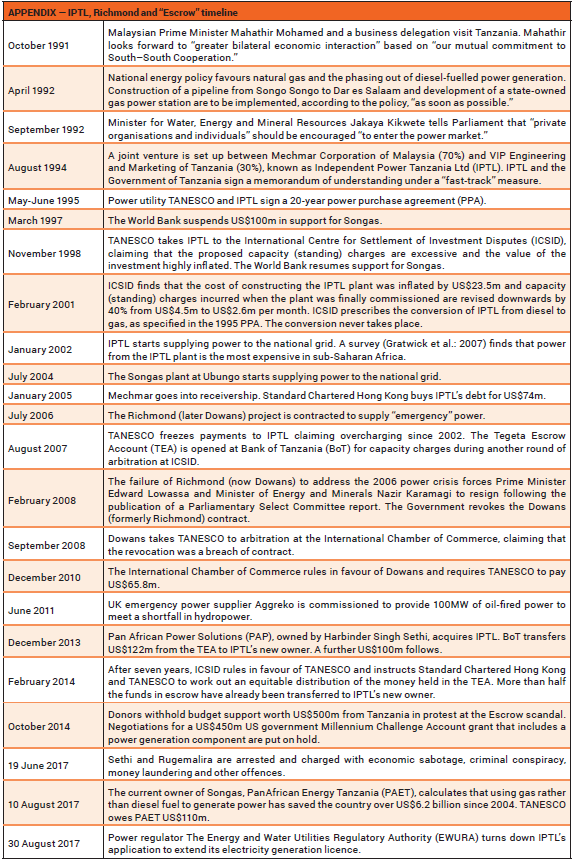

Appendix